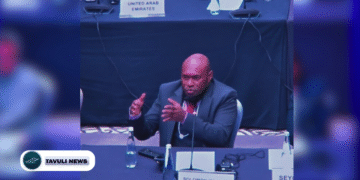

Opposition Leader Wale says Solomon Islands must address investment barriers and adopt a competitive investor mindset.

Solomon Islands has struggled to attract the level and type of investment that could significantly boost its economy, Opposition Leader Matthew Wale said during a recent parliamentary debate on the Special Economic Zones (SEZ) Bill 2024.

Wale noted that aside from the earlier success of pioneer industries such as Taiyo and GPPOL, the country has reached a bottleneck in drawing sizeable and transformative investments.

He said understanding the root causes of this investment stagnation is essential to inform appropriate policy responses.

“It is right that government should be concerned about the basis for this struggle, and seek to address the policy issues associated with it,” Wale stated.

He emphasized that Solomon Islands is competing with other countries for foreign investment and must consider this when shaping policies and investor relations.

“If we do not appreciate that we are competing with other economies for foreign investment, then our attitude towards foreign investors will be one of callous disregard for what would entice them to invest in our economy,” he said.

At a societal level, Wale warned that a failure to acknowledge this competition could foster negative and even discriminatory attitudes toward foreign investors, which could further hinder investment efforts.

He stressed that both local and foreign investments are motivated by the potential for profit, and that the country’s policy framework must make it reasonable for investors to achieve that goal.

“Ultimately, it is profits that are the one sure incentive to attract foreign investment to our economy. If a business would be profitable without fiscal incentives, private investment will jump at the opportunity,” he said.

Wale added that in cases where investments depend on fiscal incentives, the SEZ Bill is designed to provide such support. He said the success of the bill will depend on how it is implemented and how the broader investment climate evolves.

“Our attitude must also shift from one that implies foreign investors owe us something, to one that values and welcomes foreign investment,” he concluded.

Source: Office of the Leader of the Opposition